We understand you may have a few questions about the CAF Charity Deposit Platform and how it works. Below are the answers to some of the most common questions we receive. These questions and answers are updated on an ongoing basis, so do refer back to them, but equally please feel free to contact us using the link above and we will be happy to answer any questions you have.

Who are Flagstone?

Who are Flagstone?

The CAF Charity Deposit Platform is introduced by CAF Financial Solutions Limited (CFSL) and provided by Flagstone Group LTD (“Flagstone” or “the Company”).

Flagstone Group LTD (“Flagstone” or the ”Company”) is a UK registered and Financial Conduct Authority (FCA) authorised fintech company (reference number 605504) under the Payment Service Regulation 2017 for the provision of payment services.

The Company’s registered address is 1st Floor, Clareville House, 26-27 Oxendon Street, London SW1Y 4EL. The Company is registered as a data controller with the Information Commissioner’s Office under the Data Protection Act 2018 (Registration Number: ZA033774). For more information on the Company and its services, please go to: https://www.flagstoneim.com/

Flagstone deposits

How safe is the money I deposit through Flagstone?

Flagstone is authorised by the Financial Conduct Authority (FCA) and is subject to the Payment Services Regulations. Flagstone safeguards client assets at all times, holds appropriate levels of regulatory capital and generally organises and manages its business to the high standards set by the FCA.

All UK banks on the CAF Charity Deposit Platform are authorised and regulated by the FCA as well as by the Prudential Regulation Authority (PRA). Every UK bank available the CAF Charity Deposit Platform is a member of the FSCS.

Do I maintain Financial Services Compensation Scheme (FSCS) protection with deposits made onto the platform?

Yes. Every UK bank available the CAF Charity Deposit Platform is a member of the FSCS. So, if they were to fail, your charity’s eligible deposits would be protected. FSCS protection covers £85,000 per individual, per banking group. Any deposits you hold above the limit are unlikely to be covered. When creating your Flagstone portfolio, it’s your responsibility to understand which banks sit within the same banking group.

Are all banks on the CAF Charity Deposit Platform covered by FSCS?

All UK banks and building societies on the CAF Charity Deposit Platform are members of the Financial Services Compensation Scheme. Offshore banks are not eligible for FSCS coverage, or any other deposit protection, due to the jurisdiction and the trust structure in which the cash in your Flagstone account is held. You can choose to exclude banks which are not covered by the FSCS by simply clicking on ‘Only UK FSCS protected banks’ in the ‘Placing deposits’ screen ‘Filter’ options.

Who makes the FSCS claim if a bank on the CAF Charity Deposit Platform goes into administration?

If you have placed a deposit through Flagstone with a UK onshore bank that defaults, your deposit is protected by the FSCS subject to your depositor eligibility. Flagstone would make this claim on behalf of you as the underlying client. Claims relating to eligible deposits placed via the CAF Charity Deposit Platform will be paid by the FSCS as soon as possible and always within three months. For more information please refer Home

In the event that Flagstone was to go into liquidation, how are my monies protected?

Flagstone is obliged under law to implement safeguarding measures to protect clients’ funds. For this reason, all funds held by Flagstone on behalf of clients are separated from Flagstone’s own funds and only held in designated trust accounts. Were Flagstone to be placed into administration or wound up, clients would retain full beneficial ownership of their funds at all times and as such these funds would be paid back to clients by the administrator. Clients have no credit exposure to Flagstone at any time.

We hold your cash in a holding account, which you’ll use to deposit funds from into savings accounts and transfer funds back to. This account is an FSCS eligible HSBC account. You maintain 24/7 access.

For more information, please refer to Home

Technology & Security

How is the money which is transferred protected from fraudulent activity?

From a technology perspective, Flagstone protects clients’ data with “bank level” encryption and security measures. We store the minimum amount of data required to deliver our service and maintain strict policies about how this data is used, stored and accessed. During any transaction, our 256-bit encryption protects the transaction details, making it impossible for unwanted intruders to decipher.

Flagstone uses DigiCert – one of the world’s largest and most trusted SSL certificate providers. This ensures that you know you are visiting a genuine Flagstone website. We ensure that whenever you enter, transmit or display sensitive information on our website it is encrypted in transport and at rest.

Our computer systems are protected by state-of-the-art firewall technology that blocks unauthorised entry. The security of our web application has passed an independent and professional review, and external experts regularly test our systems and software.

From an operational perspective, Flagstone has adopted internal systems and controls designed to protect client funds from the risk of fraud. These include relevant IT controls, appropriate segregation of duties, restricted access rights and signature protocols.

Furthermore, Flagstone does not allow any third-party payments and all funds returned to clients are paid back to the originating funding account only.

Who will have access to your CAF Charity Deposit Platform account?

You’ll need to nominate an individual as your authorised user. This individual will have transactional access to the account. If you have a CAF Relationship Director, they will have ‘view-only’ access to your charity’s account. ‘View- only’ access will be provided as standard to all trustees or significant influencers whose details are provided within the CAF online onboarding application form. Email confirmation will be sent to all nominated individuals once the CAF account in opened.

If there’s a requirement of additional signatures to open a Flagstone account, you should contact Flagstone onboarding team at OnboardingTeam@FlagstoneIM.com.

If the authorised user requests to gain view-only access for additional users, that process will be handled after the account is opened. If this is a requirement, please contact the Flagstone Client Services team at ClientServices@FlagstoneIM.com.

Fees and charges

Share of Interest model

For each savings account your charity client opens, Flagstone will receive a share of the interest (up to 0.25%), shared with CAF Financial Solutions Limited.

The proportion payable will be based on the total value of your portfolio at the point of your deposit(s) being accepted and confirmed by the bank, and will remain applicable until the deposit is closed or matures. The proportion applied to deposit(s) will be based on your total portfolio value and is set out in your Engagement Letter.

Flagstone deducts that share from the interest rate before it features any savings account on the platform.

There are no monthly management or administration fees on this fee model.

Illustrative scenario

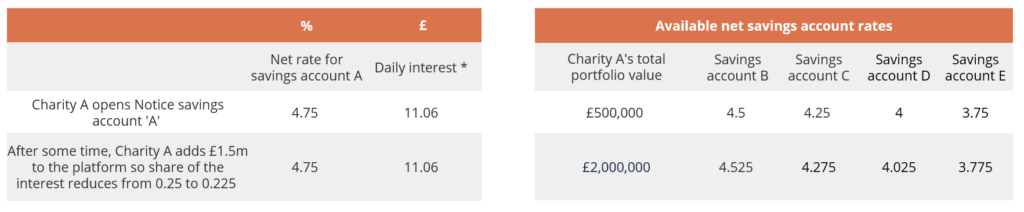

Here’s an illustrative scenario:

- Charity A opens a Flagstone account and adds £500,000 to his holding account on the platform.

- The platform sets Flagstone’s share of the interest (0.25%), according to the amount of funds charity A has on the platform. The rates displayed are the savings account gross rate, minus the applicable share of the interest.

- Charity A places instructions to open a Notice savings account with £85,000.

- Flagstone processes charity A’s instruction and opens the Notice savings account. The rate will always be the savings account gross rate, minus the share of the interest at the time the savings account opened.

- After 30 days, charity A adds £1m to their holding account. Charity A now has £1.5m on the platform, plus any paid interest.

- If the total funds on the platform mean the share of the interest changes, charity A will see the updated rates when they browse new savings accounts. Open savings accounts won’t be affected. If the total funds on the platform mean the share of the interest stays the same, nothing changes.

Here are the numbers behind Charity A’s scenario:

Management Fee model | Fees for existing referred charity clients

Existing clients will remain on the Management Fee model for now. This is until we’ve moved your charity on to the new Share of Interest model – we’ll let you know when that happens.

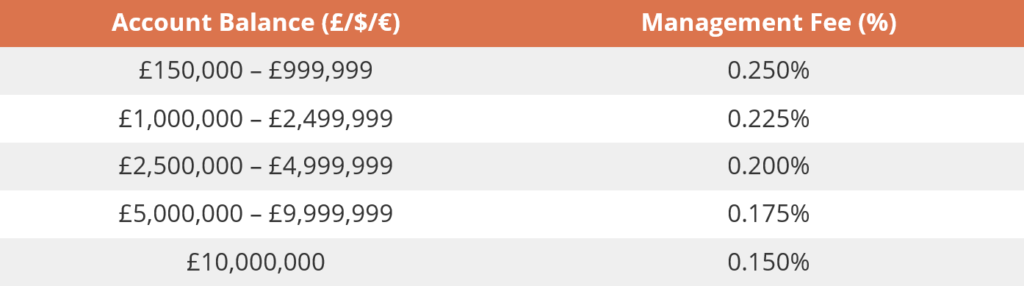

Flagstone charges a fee of up to 0.25% based on the total value of a client’s account. Fees are accrued daily and debited monthly in arrears from the fee reserve in your holding account. CAF Financial Solutions Limited (CFSL) derives a referral fee from the Annual Management Fee. This fee is included in the Annual Management Fee, and is not charged separately. Flagstone does not take any commissions or retrocessions from the banks on its platform in respect of the deposits it intermediates.

Key terms

Fee reserve: For clients on the Management Fee model, Flagstone creates a fee reserve when you make your initial deposit into your holding account on the platform. We calculate it on the basis of your initial deposit and it represents 12 months’ management fee plus the administration fee.

For example, if you fund your account with £500,000, Flagstone would create an initial fee reserve of £1,750 in your holding account. This would be calculated as follows: 12 months’ annual management fee; £500,000 x 0.250% = £1,250 plus the one-off administration fee of £500 = £1,750.

We hold the fee reserve in your holding account. The amount available for you to deposit into savings accounts has already had the fee reserve deducted. The fee is taken at maturity and debited monthly in arrears.

Flagstone holding account: This account acts as a ‘wallet’, holding your funds before you can make deposits. This account, provided by HSBC, allows you to benefit from FSCS protection on eligible deposits up to £85,000 per banking group. Money in multiple accounts with banks that are part of the same banking group (and share a banking licence) are treated as one bank.

Your funds will be returned to your holding account when:

you have given notice on a Notice account and the notice period is complete

you request to withdraw cash from an Instant Access account

your Fixed Term deposits mature

General

Why do banks work with Flagstone?

Flagstone provides its partner banks with a distribution channel that enables them to source valuable deposit funding in a controlled and cost-effective way.

How can Flagstone access better interest rates for clients?

The relationships that Flagstone has developed with its partner banks and the volume of deposits it intermediates often give Flagstone access to deposit rates that are otherwise unavailable to direct client applications.

What is the ‘Holding Account’ and what is it used for?

Your holding account is set up to receive and hold your funds before they are transferred to deposit accounts. Your holding account acts as the account to which all monies (principal and interest) are returned at the maturity of a fixed term deposit account, or a notice account is closed. Once the matured funds are deposited in your holding account, you may then withdraw them to your nominated account, or place them in another deposit account of your choosing. The holding account is provided by HSBC.

What happens when the charity wants its cash back from the platform?

When you want your charity’s money back from the CAF Charity Deposit Platform, you will need to provide an instruction to return funds via the Platform. Any money being returned will only be sent to the nominated account, for which the client provided details in their initial application.

I would like to make a transfer from one of the banks I have money with on the CAF Charity Deposit Platform, is this possible?

No. All monies transferred from a Flagstone partner bank can only be sent back to your holding account. Once monies are received into the holding account they can only be transferred to your nominated account.

Can I directly contact the banks that I place money with through the CAF Charity Deposit Platform to discuss my deposits?

No, all contact has to go through the Flagstone client services team on 020 3745 8130 or at ClientServices@FlagstoneIM.com

Will the banks that the charity places money with through the platform be able to market products and services to me?

No, the banks will not contact you directly and all contact will be through the Flagstone client services Team on 020 3745 8130 or at ClientServices@FlagstoneIM.com

If I have a problem or a query, who do I contact?

Please contact the Flagstone client services team on 020 3745 8130 or at ClientServices@FlagstoneIM.com.

What is a nominated account?

Your nominated account is the account to which Flagstone will pay your monies when you request them back from your Flagstone holding account. This is the only account to which we will transfer your money from your holding account on receipt of a withdrawal request from you. Your nominated account details were provided by you in your application form. It must be a UK onshore bank account matching the name of your Flagstone account.

All payments to your Flagstone holding account must be made from your nominated account. Any payments received in your holding account that are not from your nominated account will be returned to the remitting bank account.

New Accounts & Placing Deposits

How long does it take to open a holding account?

Once Flagstone’s client services team have confirmed that they are in receipt of all documentation and information that is required from you, then we aim to have your holding account opened for you in 48 hours.

How long does it take to open accounts with the other banks on the CAF Charity Deposit Platform?

The account opening process with each bank is slightly different and thus takes a different time depending on the specific institution. As a guide it should never take more than five working days to open an account, although some banks are significantly quicker than this and open accounts for Flagstone on a same day basis.

Do I have to set up a new account with each bank on the CAF Charity Deposit Platform every time I place a deposit with that bank?

No. Once an account has been set up at a partner bank it can be used again. Flagstone does however reserve the right to close accounts at its sole discretion if, in its opinion, such accounts are not being, or are unlikely to be, utilised.

When a new deposit rate is selected on the Platform, is the rate guaranteed at that point?

No. Interest rates are only confirmed at the point a deposit is physically made (i.e. once the relevant account has been opened). If the rate is the same (or better) than the one selected, then Flagstone will automatically place the deposit. If, however, a rate moves downwards between the time a deposit is instructed and the time it is placed, then Flagstone will contact you to confirm the new rate prior to your deposit being placed.

How do I update or change my details?

Some of your details can be updated in the admin section of the Platform. If you are unable to update on the Platform, please contact the Flagstone Client Services Team on 020 3745 8130 or at ClientServices@FlagstoneIM.com and we will confirm the process required.

If I open a notice account, does it automatically close at the end of the notice period, or do I need to instruct its closure?

With a notice account, the funds remain in the account indefinitely until you provide Flagstone with notice that you would like to return the funds to your holding account. Once you provide an instruction, Flagstone will give notice to the bank and the notice period will start (e.g. 120 days for a 120 day notice account). It is not possible to shorten this notice period and so, before opening a notice account, you should be comfortable that you will not require access to your cash for any other purpose without giving the required notice period. When the instruction has been placed and the notice period expires, funds will be automatically returned to your holding account. Once the funds are back in your holding account, Flagstone will send you a confirmation by email.

Are the interest rates shown on the Platform gross rates or annual equivalent rates?

In the Share of Interest model, all interest rates on the CAF Charity Deposit Platform are net of our share of the interest. So the rate you see will always be the rate you receive.

If I open a fixed term deposit account can the funds be withdrawn before the end of the term?

A fixed term deposit account is a cash savings account which offers a fixed rate of interest on a fixed balance over a fixed period of time. Fixed term deposit accounts generally pay a higher interest rate than variable rate accounts. The longer the fixed rate term, the higher the interest rate tends to be. Once your fixed term deposit account is opened, the amount, term and rate are fixed, and you cannot therefore make transfers to or from the account.

It is not possible to shorten or break the term for a fixed term deposit account and so, before opening such an account, you should be comfortable that you will not require access to your cash for any other purpose during the fixed term period. You should also note that, because the rate is fixed, you may find your savings are locked into a fixed rate that looks less competitive if interest rates in general rise.

I already have an account with Flagstone and now would like to place US Dollar or Euro deposits, what do I need to do?

Please contact the Flagstone client services team on 020 3745 8130 or at ClientServices@FlagstoneIM.com and they will be happy to discuss setting up a new Euro and/or US Dollar holding account with you.

What about tax reporting, how does Flagstone help me with that?

Flagstone will provide you with a summary (within two months after the year end), detailing the interest earned on all of your accounts.

Fitch Solutions Financial Implied Credit Score

What is the Fitch Solutions Financial Implied Credit Score?

To help you make informed decisions when choosing which institutions to place your deposits with, clients can view and compare Fitch Financial Implied Credit Scores (FICS) for every bank on the Platform. Fitch Solutions is a leading provider of credit ratings, commentary and research for global capital markets. FICS provide an indicator of the standalone financial strength for 23,800 banks, including all of the banks on the CAF Charity Deposit Platform. Each bank’s FICS Score is now shown in the platform’s portfolio builder for clients to reference when selecting an account.

How are Fitch Solutions Financial Implied Credit Scores calculated?

Fitch Solutions Financial Implied Credit Scores (FICS) use a proprietary model to provide an indication of the standalone financial strength of a bank using logistic regression based on four variables:

- Total reported assets of the bank.

- Loan quality (using the reported loan impairment charge to reported average gross loans).

- Profitability (using reported operating profit to reported average total assets).

- Fitch Solutions Country Risk Indicator.

For each bank, a letter is assigned as an indicator. For each bank, a letter is assigned as an indicator of credit worthiness from ‘aa’ to ‘c’. FICS also provide an indication of how close a bank is to being in a different credit score band by using the modifiers ‘+’ or ‘-‘. This enables banks to be ranked within a credit score band and importantly, an indicative way to detect whether credit quality is perceived by Fitch Solutions to be deteriorating or improving over time.

The score categories are listed for clients and explained in more detail on the Platform in the ‘Help’ section under ‘Bank Implied Credit Scores and Credit Ratings’.

Does Flagstone provide credit rating scores from other credit ratings agencies?

Where they are available, clients can also see credit ratings for the banks providing accounts on the platform from the three largest Credit Ratings Agencies (CRAs) recognised by the European Central Bank; Standard & Poor’s (S&P), Fitch and Moody’s. These CRAs undertake analysis and assign letters as indicators of credit worthiness (from ‘AAA’ to ‘D’ for S&P and Fitch, and from ‘Aaa’ to ‘C’ for Moody’s).

The CAF Charity Deposit Platform is provided by Flagstone Group Ltd and introductions are made by CAF Financial Solutions Limited (CFSL).

Minimum amount to open a CAF Charity Deposit Platform account is £150,000

CAF Financial Solutions Limited (CFSL) is authorised and regulated by the Financial Conduct Authority under registration number 189450. CFSL Registered office is 25 Kings Hill Avenue, Kings Hill, West Malling, Kent ME19 4TA. Registered under number 2771873. CFSL is a subsidiary of Charities Aid Foundation (registered charity number 268369).

Flagstone Group Ltd is authorised by the Financial Conduct Authority (Reference Number 605504) under the Payment Service Regulations 2017 for the provision of payment services. Flagstone, 1st Floor, Clareville House, 26-27 Oxendon Street, London, SW1Y 4EL

© Copyright 2022 Flagstone Group Ltd